CFO Solutions for Growing Businesses

We combine CFO insight, accounting precision, and digital innovation to help you make better decisions, faster.

From startups to middle market companies, we turn complexity into clarity for Founders, CEO’s, and Institutional Investors.

Put simply, we’re your trusted financial partner.

Did You Know?

82%

Cash Flow Management

82% of small businesses fail due to poor cash flow management or a lack of understanding of cash flow.

40%

Trust in Financial Data

Nearly 40% of CFOs worldwide do not completely trust the accuracy of their organization’s financial data, which can hinder strategic decision-making.

84%

Work Hours & Productivity

84% of business owners work more than 40 hours a week, yet many feel they are not accomplishing their most important tasks.

CFO Solutions for Businesses

Many small and growing companies struggle with managing their cash flow, understanding their financial health, and making smart financial decisions. A lack of financial leadership can leave businesses uncertain about their financial health and without a clear path to growth.

We step in to provide the financial clarity and guidance these businesses need. We help organize financial reports, improve cash flow, create budgets, and develop strategic plans for growth. By offering expert insights and leadership, we empower businesses to make informed decisions, increase profitability, and maintain financial stability.

Nothing New Under the Sun

Every business is unique, but share a common set of challenges that affect their growth and stability, including:

Cash Flow Problems

Lack of Financial Planning

Unpredictable Revenue Streams

Limited Access to Capital

Time Management & Burnout

Misinterpreting Financial Data

Why Do You Need a CFO?

A CFO helps a business manage its money, plan for the future, and stay financially healthy. As a company grows, handling cash flow, budgeting, and financial decisions becomes more complicated. A CFO makes sure there’s enough money to keep things running, keeps costs under control and helps identify financial risks and makes plans to avoid them. A CFO is key to making smart financial moves and avoiding costly mistakes.

When is the Right Time?

If your company is expanding or you’re finding financial management challenging, a fractional CFO can step in to handle budgeting, cash flow, and financial planning. They offer the expertise you need for growth, all while providing the strategic guidance your company needs without the high cost of a full-time role.

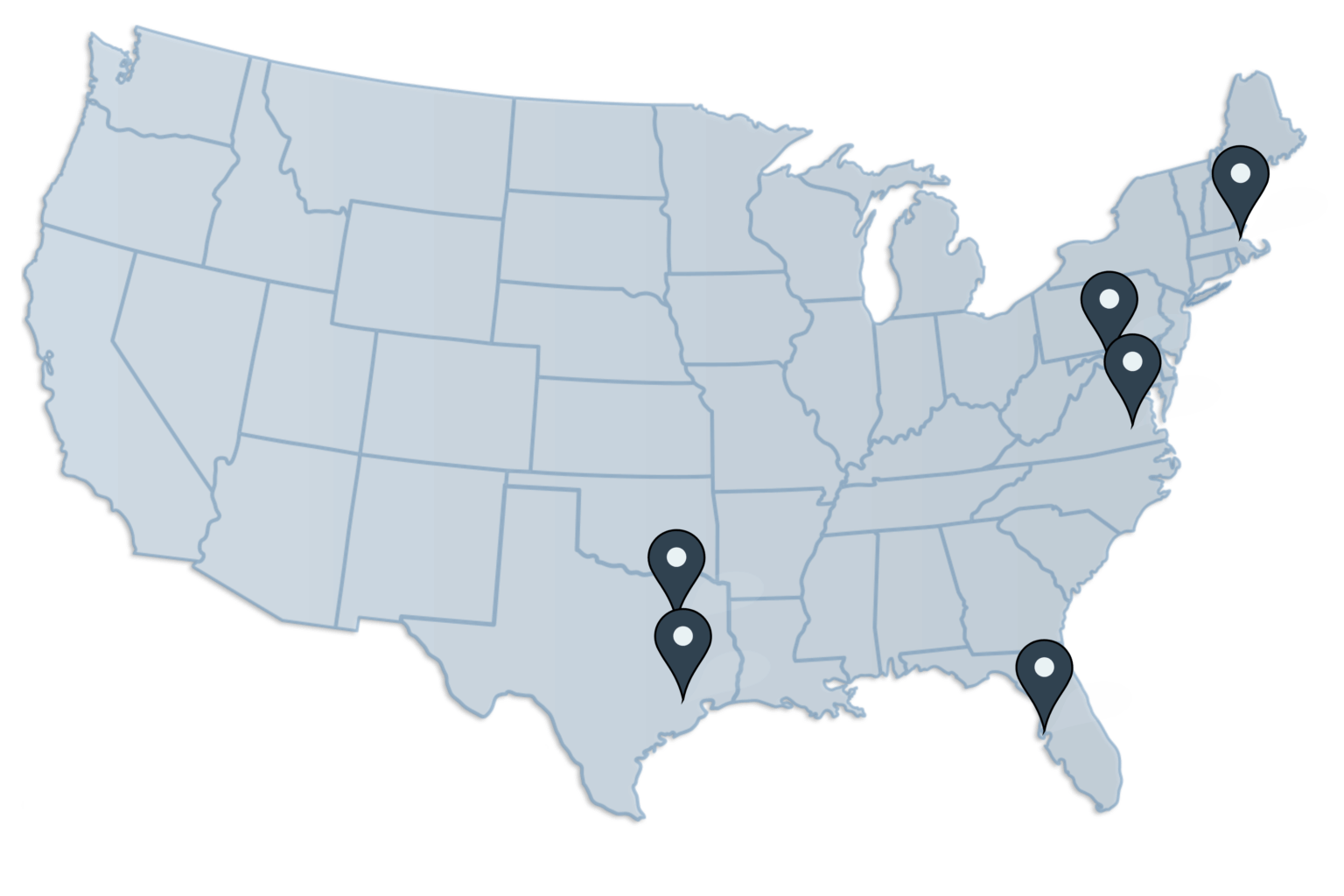

Locations

Boston Born, Serving Near and Far

We work remotely to keep things efficient and flexible, but we know the value of in-person connections. When needed, we come to you – whether it’s for important meetings, strategic planning, or just to get a better feel for your business. Our goal is to provide the best financial guidance in a way that works best for you.